Q: Palisade is known for buying watches and gold, but you also buy diamonds?

Ron: Diamonds always have value and there is a value to just about any diamond no matter how large or small and no matter the quality. We try to buy all kinds of diamonds, some are much more popular than others, certain shapes like round stones. Not as popular right now are pear shapes, marquise, heart-shaped. Sometimes those shapes are recut, sometimes the diamonds are used to be put in other pieces of jewelry, like diamond necklaces or multi-stone rings.

Q: How do I get the most for my diamond?

Ron: Someone who has a diamond to sell wants to get the most they can for that diamond, and to get the most, you want to find someone who is willing to buy it right away, as opposed to taking a diamond on consignment.

The way to get the most right away is to sell a diamond to someone who has the resources to move that stone, whether it’s to a retail market, to the public, or within the dealer world, where a lot of diamonds are traded.

And we have that experience and expertise and connections to usually get a very good price based on current market conditions and can have the resources to pay for the diamond right away.

Q: What’s the difference between consignment stores versus an active buyer like Palisade?

If a retailer buys a diamond from someone and they are going to stock the stone, either on consignment or to purchase for their inventory, they want to pay as little as possible. It’s about the allocation of resources. They’re laying out cash that they don’t recoup until they sell the ring. So there’s a cost to stocking the stone - keeping the lights on and running the store have to figure into what they can offer you based on how quickly they think they can move the stone. If they’re going to stock that stone and it’s going to sit there forever, they don’t want to spend too much on it.

Diamonds are fluid, it’s a commodity that’s constantly trading, I’m actively in the market, and time is money. For me to give you the most for your diamond I need to sell that stone fast. If I see a diamond for $10,000, if I can get $10,500 for it tomorrow, I’ll pay you $10,000 – it doesn’t matter what the cost of the diamond is, or what the diamond is worth, if I can flip it and make some profit, it’s better than making no profit. So if you come in with a stone that’s not so popular and you think it’s worth a lot but it’s difficult to sell, well, I’ll try and find someone to buy it. But if I’m going to stock that diamond, do I want to take the $10,000 and tie it up for something that’s only worth $10,100 or 10,500….when I could loan that money at 4.5, or buy something that has more value? No.

Q: I read that the big diamond stores don’t own the diamonds they stock. What’s that about?

Ron: So when you’re going into a jewelry store looking for diamonds, and some stores have many, many diamonds in stock, chances are that it’s not their own inventory. That they are stocking a least some stones that are someone else’s.

I just sold a diamond engagement ring to someone and I brought in the kind of stone that he wanted ..a 2 carat stone. I might have my own inventory, but it may not be exactly what he likes, so I brought in diamonds from three other dealers. Some were very similar, some changes, every diamond is slightly different, and he picked a stone. And I sell it and make a small mark up. I didn’t pay to inventory the diamond. And I don’t know how much the person who sold it to me made, but they’re happy to move that stone also.

Q: So you can make a smaller margin if you’re moving larger volume?

Ron: Right. Like I just bought a diamond pin from someone. And I was getting $2400 for the pin. And I paid them $2150. I made $250 and it took some phone calls, some discussion, and that’s that. I want to offer as much as I can for the piece. The problem with the business today is that there not as much volume. The market’s saturated.

So the answer is, when it comes to us or anyone else, does the buyer have the resources to move the diamonds and get the customer the highest prices that they can get.

Q: So I shouldn’t take the first offer for my diamond?

Ron: What’s the most important thing in selling anything? Trust. People have shopped around and sometimes I’m the best, sometimes I’m not. You never know who is willing is take a chance on a certain stone. Like I’ll have a diamond and I’ll check with three or four guys I know who are willing to write a check…some are a few hundred dollars more or less, but we will attempt to buy every diamond.

Q: You’re describing an actively trading market. So how are diamonds priced? Is there a standard?

Ron: Yes and no. There's the Rappaport Price Guide; it’s an industry price guide that gives price per carat depending on total weight of the stone. And the trade generally deals off of that price list. But every diamond is different and priced on 4c’s, so it’s just a guide.

Q: Wait, so the price per carat isn’t the same depending on the total weight? Can you explain that?

Ron: Sure. The bigger the stone the more rare it is, so a four-carat diamond is worth much more than 4 one carat diamonds. The total weight of the stone affects the value.

Q: So does the appraised value provide a guide to the market value for my diamonds?

Ron: Not really. If you went to 10 different dealers and got a diamond appraised you probably would get 10 different appraised values. There’s is some subjectivity to the value of a diamond. The clarity and quality are unique to each diamond.

You can go to a couple of gem labs in New York that will also give you value, and that value is usually way, way inflated. It’s for insurance, it’s for ego, it’s to help the seller make the diamond seem better than what was paid. Some people like that.

And of course if you go to buy a diamond you’re going to pay more than if you’re going to sell the same diamond.

Q: Even if you go to the GIA?

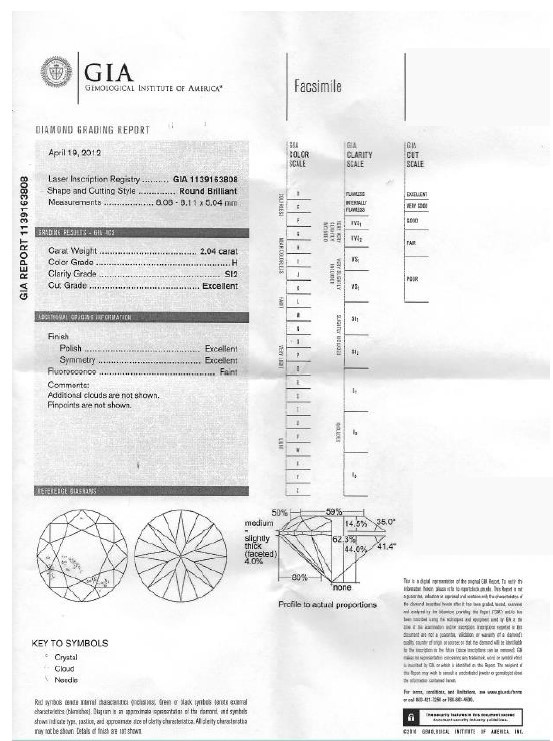

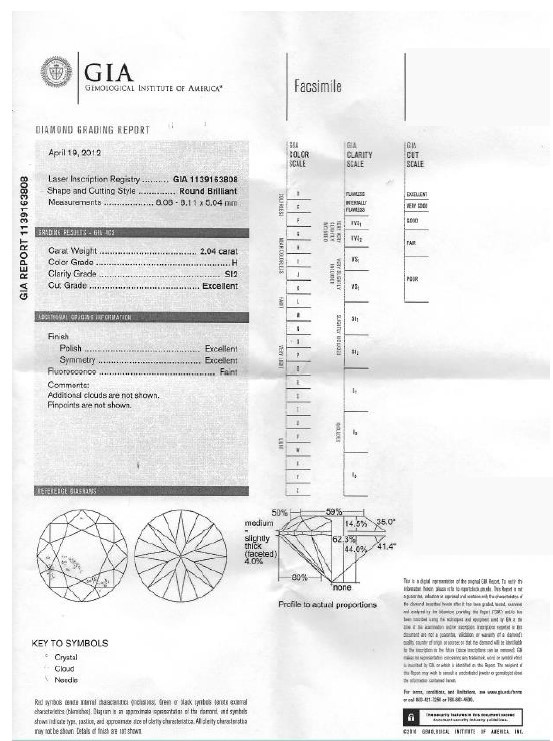

Ron: If you went to get your diamond appraised by GIA, the Gemological Institute of America, they don’t grade value, they just grade the quality. I’m member of GIA. GIA is the top authority when it comes to grading diamonds. But if you look at a GIA report, here’s and example, they are describing and grading the stone. They don’t provide a dollar value for it.

Q: So if I’m valuing my diamond, which of the four c’s which counts more?

Ron: The quality really is a combination of all four: cut, color, clarity, and carat weight.

Some cuts are more popular and easier to sell than others, but every stone is worth something. Cut is not the same as shape: it’s how deep or shallow the proportions, how it reflects light, how balanced the shape, how many facets. So, for example, there are stones, like the “Old Miner’s” or European cut, in the 20s, 30s, 40s, it was an old way of cutting stones before someone came up with the a modern cut, a round brilliant cut. But often an old Miner will have a flat culet, which is the bottom point of a stone. In an old miner the culet will be faceted flat so when you look through the diamond you see a sort of hole, as opposed to all the light coming to a point, which is a round brilliant cut – RBC.

Q: What about color diamonds? Do you trade in those?

Ron: I don’t do a lot with color stones, it’s a whole other specialty. Like “chocolate diamonds” are a way to sell very brown diamonds, I personally don’t like them, I like white diamonds. If you look at auctions and see these rare large pink diamonds that go for millions. But you have to be cautious because there’s a lot of color enhancement going on in today’s market. Color stones have to be checked out.

Q: And clarity?

Every stone has some flaw, like a fingerprint. A GIA report will show where the inclusions are located. They also grade the cut, the polish, the symmetry; whether it has fluorescence. Typically you want none or faint. Some diamonds have some faint fluorescence so they will glow under fluorescent light. It’s not an inclusion, sometimes it gives it a little more life, sometimes it can give it a cloudy look, it depends on the diamond.

Some diamonds are treated. There are people who treat them with lasers who try to decrease the amount of inclusions. It kills the value. It can help the look, but it doesn’t make it easy to sell. You have to study the stone to see if there are signs of enhancement.

Q: Is there anything to exact carat weight?

One carat exactly in a good quality stone and very good cut is cool but I don’t know that it adds more value. But people want a 1 carat diamond vs. a .99 pointer. The difference in weight is insignificant, but that one point psychological difference is huge. I sold a diamond yesterday to a guy and his girlfriend wants a 2 carat stone. I showed him a 2.01. 2.03, 2.06. I can show him a 1.99 that looks bigger than those, and he can’t buy it because she has to have a 2 carat stone

Q: Do you buy little diamonds?

Ron: Little diamonds are called melle. They range from .001 carats to .18 carats, just below a fifth of a carat. Little diamonds have value, but it takes a lot of small stones to make the amount significant. There is a market for them because when use melle, you want to match the stones.

And there are small stones that are very high quality. Rolex will put very high quality diamonds in their watches. Tiffany, Cartier, use very good stones, even though they’re small. You can definitely tell the difference. You go to some of these diamond exchange places that have a lot of commercial goods, they’re not picking out the cleanest stones, they usually have a lot of inclusions. If you buy a piece at Cartier the diamonds don’t have any inclusions…they’re very lively diamonds

Q: Does being a registered diamond make any difference?

Ron: Registering, where they laser a number into the stone, helps identify it if something happens. It doesn’t increase the value. Here’s the thing, let’s say a diamond is bought at Tiffany. Usually their diamonds are of a certain quality. But when you take that diamond out of the setting, it’s not a “Tiffany” diamond, it’s just a diamond. Same with Harry Winston’s. They might be very good cuts and high quality stones, but they are what they are.

Q: Because all diamonds are old?

Ron: (Laughs) Even the stone you’re being sold as new is a billion years old. Hard to tell if it’s repurposed unless you follow the diamond from the mine to the cutter and it’s the first time it’s been used in a ring.

Ron: (Laughs) Even the stone you’re being sold as new is a billion years old. Hard to tell if it’s repurposed unless you follow the diamond from the mine to the cutter and it’s the first time it’s been used in a ring.

Q: Some marketers are doing that, showing the diamond’s ‘journey.’

Ron: It’s done but even in that case, the rock is billion years old, it comes out of the earth.

Q: So who do you buy diamonds from?

Ron: I buy a lot from people who get divorced or inherit them and don’t want them, are never going to wear it and need the money. The person who inherits a diamond that’s worth $10,000, I’m not trying to buy it for $3000, I’m trying to buy it for $9000. I want to be a place that’s trusted to buy your stone, or give an opinion, give a price, discuss value and try to help you sell your diamond.

Q: I hope I never need to sell my ring but if I do, I’ll come to Palisade!

Ron: We’ll be here.

TESTIMONIAL

“My experience buying a pre-owned Rolex from Palisade Jewelers was perfect. I did the transaction by phone. The watch arrived, exactly as described; they gave me good, attentive service.”

- Richard

CALL OR COME

SEE US

Visit our store for a personal consultation with our watch and jewelry experts.